Setting Up a New Loan in QuickBooks

by Laura Madeira | April 19, 2013 9:00 am

To use QuickBooks to track your recurring loan payment, follow these steps:

- From the menu bar, select Banking, Loan Manager.

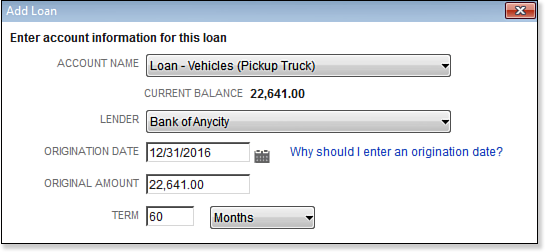

- Click Add a Loan and complete the information as displayed here:

[1]

[1]Complete the account information for the loan.

- In the Account Name drop-down list, select the long-term liability account for the loan.

- In the Lender drop-down list, select the payee.

- Enter the loan Origination Date.

- In the Terms drop-down list, select Weeks, Months, or Years. Click Next.

- Enter the Due Date of Next Payment, Payment Amount, and optionally, Next Payment.

- Select the Payment Period.

- (Optional) Choose Yes or No to making an escrow payment and complete the fields for Escrow Payment Amount and Escrow Payment Account.

- (Optional) Select the box to be alerted 10 days before the payment is due. Click Next.

- Enter the Interest Rate and select a Compounding Period.

- Choose a bank account from the Payment Account drop-down list.

- Choose the Interest Expense Account and the account for Fees and Charges.

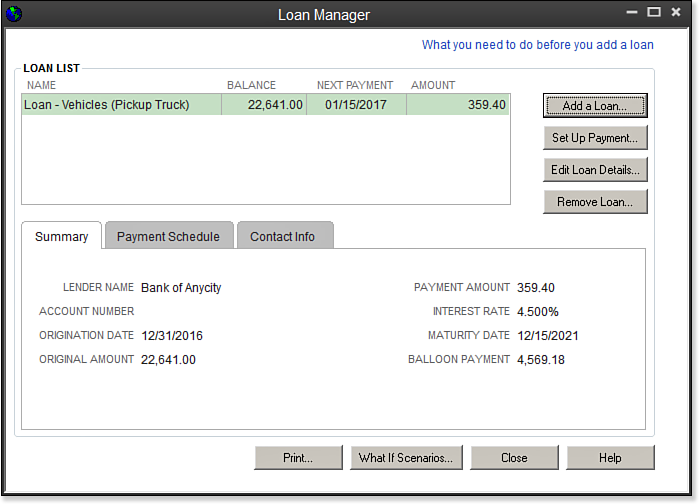

- Click Finish. QuickBooks displays information in the Loan Manager about the newly created loan, as shown here:

[2]

[2]Use the Loan Manager to track long-term loan details.

From Laura Madeira’s QuickBooks 2013 In Depth[3]

Resources:

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/03/18.8.bmp

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/03/18.9.bmp

- QuickBooks 2013 In Depth: http://www.quick-training.com/quickbooks-2013-in-depth/

Source URL: http://www.quick-training.info/2013/04/19/setting-up-a-new-loan-in-quickbooks/