Tracking Customer Deposits in QuickBooks

by Laura Madeira | May 17, 2013 9:00 am

Do you require your customers to pay a deposit in advance of the product shipping, or the service being provided? You might want to track these in one of two ways:

- As a credit to Accounts Receivable for the specific customer

- As a credit to an Other Current Liability account

You might want to ask your company accountant which method is preferred. Using the first method is often easier and takes fewer steps. The second method of using a current liability account reports the prepayment in the proper category on the business’s balance sheet.

If you are choosing the first method listed previously, you would create a receive payment when your customer pays and not assign the payment to an invoice. In effect, this debits (increases) your Undeposited Funds account or bank account and credits (reduces) accounts receivable.

If you choose to use the second method, follow these steps:

- If needed, start the process to create a Customer Deposits account by selecting Lists, Chart of Accounts from the menu bar.

- Click the Account button at the bottom of the screen and select New.

- In the Add New Account dialog box that opens, from the Other Account Types drop-down list, select the Other Current Liability type account and follow the remaining steps on the screen.

- Create an item to be used on invoices for this prepayment. From the menu bar, select Lists, Item Lists.

- Click the Item button on the bottom of the list and select New.

- In the New Item type drop-down list, select Other Charge.

- In the Item Name/Number field, type a name such as Customer Deposits. Enter an optional description and select the Customer Deposits other current liability account from the Account drop-down list.

- Prepare your invoice to the customer for the amount of the prepayment you are requiring. When the customer pays, record the Receive Payments transaction.

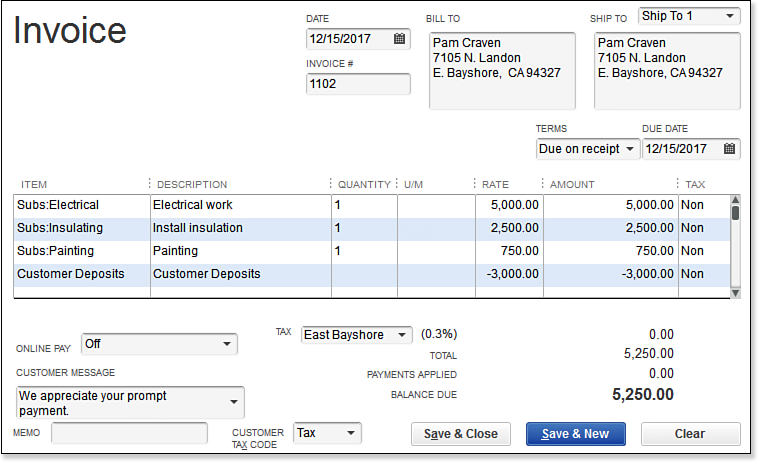

- When the project is completed and you are ready to recognize the revenue associated with the sale, create your invoice using the item(s) that were sold to the customer. On the next available line of your invoice, use the Customer Deposit item, only this time enter a negative amount. As shown here:

[1]

[1]Proper accounting for customer deposits paid on the final invoice when you track

the original payment as a liability.

QuickBooks records the revenue in the period the sale was complete, and the final invoice will be reduced by the amount of the deposit previously paid.

Using the method described here does have a trade-off. If you are a cash basis taxpayer, you would not expect to see a balance in your Accounts Receivable account when the Balance Sheet report is prepared on a cash basis. However, when you use this method, you will see an Accounts Receivable balance on a cash basis Balance Sheet report. One of the causes of this is that QuickBooks reports an Accounts Receivable balance on a cash basis Balance Sheet report when items are used that map to other Balance Sheet accounts.

From Laura Madeira’s QuickBooks 2013 In Depth[2]

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/03/10.50.bmp

- QuickBooks 2013 In Depth: http://www.quick-training.com/quickbooks-2013-in-depth/

Source URL: http://www.quick-training.info/2013/05/17/tracking-customer-deposits-in-quickbooks/