Your purchase of an Intuit payroll subscription includes periodic tax table updates. When the federal or state government makes changes to payroll taxes or forms, you will be notified that a new tax table is available.

To update your tax tables, make sure you are connected to the Internet and you have a current payroll subscription.

To update payroll tax tables, follow these steps:

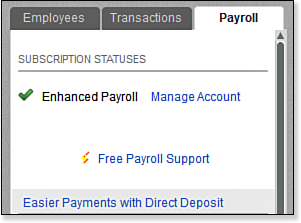

- From the menu bar select, Employees, Payroll Center. Your payroll subscription status is detailed to the left, as shown here:

- From the menu bar select Employees, Get Payroll Updates.

- (Optional) Click the Payroll Update Info button for details about the currently installed tax table version.

- (Optional) Click the Account Info button. You will need to sign into your account to view the QuickBooks Payroll Account Maintenance information about your subscription, including type of service, payroll company FEIN information, billing details, and direct deposit details. Click the X in the top-right corner to close the QuickBooks Payroll Account Maintenance dialog.

- Select the option to download only changes and additions to the installed payroll files or download the entire payroll update. Click the Update button.

- Click OK to close the Payroll Update message that tells you a new tax table or updates were installed. Click Troubleshooting Payroll Updates if the update does not install successfully.

- QuickBooks opens the Payroll Update News dialog box. Click through the tabs of information to learn more about changes made with the installed update. Press the Esc key on your keyboard to close.

- From the menu bar select Employees, Payroll Center.

- On the left side of the Payroll Center, view information about your payroll subscription status.

Here’s another tip from Laura Madeira’s QuickBooks 2013 In Depth:

Because payroll requirements are changing all the time, make sure you have an accounting professional who can review your payroll setup, or who can file the returns for you.

From Laura Madeira’s QuickBooks 2013 In Depth