Unless you take each and every check or cash payment from your customers to the bank, on a separate bank deposit ticket, your customer payments should be grouped together with the total matching your bank deposit slip.

If you group your customer payments on the same deposit transaction, and match the total deposited to your bank deposit ticket, your bank reconciliation will be much easier to complete each month.

You should not attempt this correcting method if you have reconciled your bank account in QuickBooks. Also, if you are correcting years of unreconciled transactions, this method might just be too tedious.

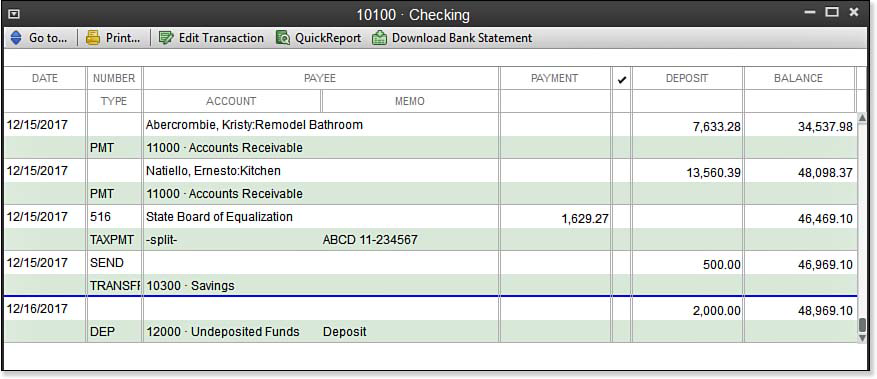

The easiest place to see the problem is in your bank account register. From the menu bar, select Banking, Use Register, and select the appropriate bank account.

As shown in the image below, assume the deposit total per the bank records on 12/15/17 was $21,193.67, but in the QuickBooks checkbook register, you recorded two individual deposits.

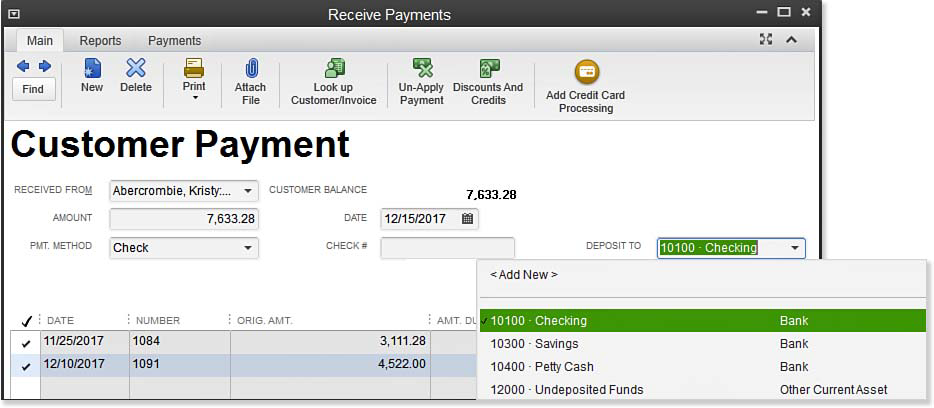

This situation was caused by choosing Checking as the Deposit To account when receiving the customer’s payment, as shown here:

The preferred method would have been to select Undeposited Funds and group them on one deposit transaction.

To correct these errors (be aware, it is a time-intensive process if you have many months or years of transactions), follow these steps:

- From the displayed Receive Payments transaction that was originally deposited directly to the bank account, select the Deposit To drop-down list and choose Undeposited Funds.

- From the menu bar select Banking, Make Deposits. QuickBooks displays a list of all the payments received, but not yet included in a deposit (included in the Undeposited Funds balance sheet account balance).

- Click to place a checkmark next to the grouped payments, and verify that the total deposit agrees with each individual bank deposit.

- Click OK. The make deposit transaction now agrees with the actual bank deposit recorded by the bank.

From Laura Madeira’s QuickBooks 2013 In Depth