How to Create Payment Terms in QuickBooks

by Laura Madeira | August 30, 2013 9:00 am

QuickBooks terms offer a shortened description, and calculate on an invoice, when you expect to receive payment from a customer, or when a vendor expects to receive payment from you. For example, 1% 10 Net 30 is an expression for payment due in 30 days, 1% discount, if paid within 10 days.

To practice creating a payment term, open a sample data file. You might also use these instructions if you are creating a new payment term in your own data file:

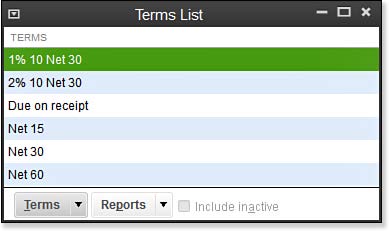

- From the menu bar select Lists, Customer & Vendor Profile Lists, Terms List. A list of terms displays, as shown in the image below:

[1]

[1]Terms lists calculate due dates on customer and vendor transactions.

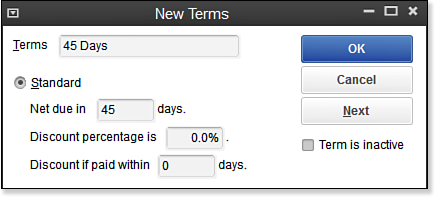

- In the Terms drop-down list, select New. The New Terms dialog box displays, as shown here:

[2]

[2]Complete all the fields when creating a new payment term.

- In the Terms field, type 45 Days.

- Select the Standard option and type 45 in the Net Due In field.

- Click OK. You are returned to the Terms List.

- (Optional) Click the Reports button and then select QuickReport to prepare a report of transactions using the selected term.

- You can now assign this term to customer and vendor transactions.

If you want the due date to be a specific date, use the Date Driven terms and complete the necessary fields.

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/08/9.26.jpg

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/08/9.27.bmp

- QuickBooks 2013 In Depth: http://www.quick-training.com/quickbooks-2013-in-depth/

Source URL: http://www.quick-training.info/2013/08/30/how-to-create-payment-terms-in-quickbooks/