Did your review of the data uncover old dated payment transactions still in the Undeposited Funds account? If yes, use the following method to remove these payments without editing or modifying each transaction.

This method of correcting makes the following assumptions:

- Your bank account is reconciled before making these changes.

- You have reviewed your Accounts Receivable Aging reports, and if necessary have made corrections.

- You have identified which payment amounts are still showing in the Undeposited Funds account, and these are the same amounts that have already been deposited to your bank register by some other method.

- You have identified the specific chart of accounts (typically income accounts) to which the deposits were originally incorrectly recorded.

This method enables you to remove the unwanted balance in your Undeposited Funds account with just a few keystrokes. To remove old payments in the Undeposited Funds account, follow these steps:

- If the funds that remain in your Undeposited Funds account are from more than one year ago, you first should identify the total amount that was incorrectly deposited for each year. See my next post about “Creating a Payment Transaction List Detail Report.” Filter the report for the specific date range.

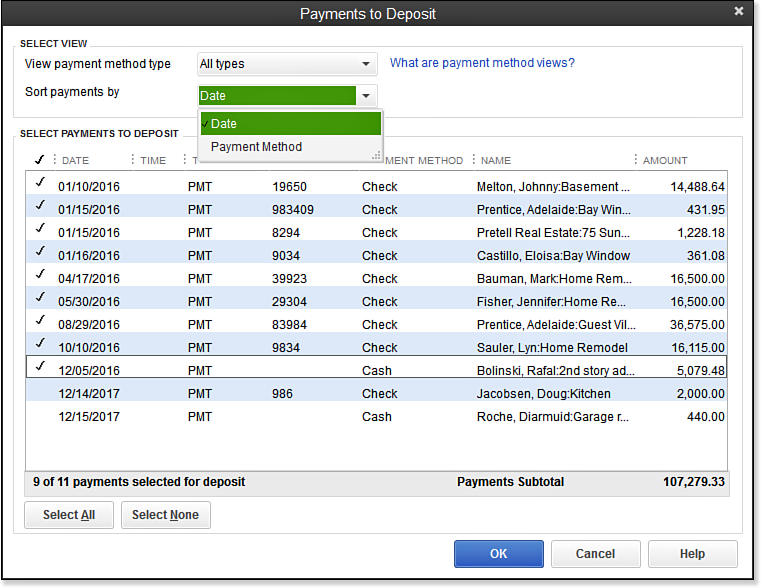

- Now start the process of removing these identified Undeposited Funds items by selecting Banking, Make Deposits from the menu bar. The Payments to Deposits dialog displays. From the Sort Payments By drop-down list, select Date. See image below:

- In the Payments to Deposit dialog box, select all the payments for deposit with dates in the date range you are correcting by placing a checkmark next to the payment items. Click OK. The Make Deposits dialog box opens with each of the previously selected payments included on a new make deposit.

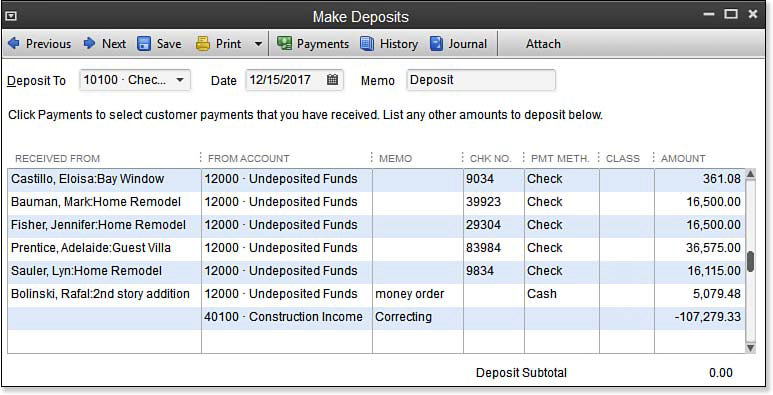

- On the next available line, enter the account to which the incorrect deposits were originally recorded. In this example, you discovered that the Construction Income account was overstated by the incorrectly recorded deposits. The effect of this new transaction is to decrease (debit) the Construction Income account and decrease (credit) the Undeposited Funds account without any effect on the checking account, as shown here:

- Make sure to mark as cleared this net -0- deposit in your next bank reconciliation.

–> A word of caution: The date you assign the Make Deposits transaction is the date the impact will be recorded in your financials. You have several important considerations to take into account when selecting the appropriate date:

- Are the corrections for a prior year?

- Has the tax return been prepared using current financial information from QuickBooks for that prior period?

- Has another adjustment to the books been done to correct the issue?

If you answered yes to any of these, you should contact your accountant and ask advice about the date this transaction should have.

You should now be able to review the Undeposited Funds Detail report and agree that the items listed on this report as of today’s date are those you have not yet physically taken to your bank to be deposited, or the credit card vendors have not yet credited to your bank.

From Laura Madeira’s QuickBooks 2013 In Depth