How to Fix Incorrectly Recorded Sales Tax in QuickBooks

by Laura Madeira | September 6, 2013 9:00 am

This CDR feature not only identifies errors with using the incorrect payment transaction, but also fixes the transaction automatically for you!

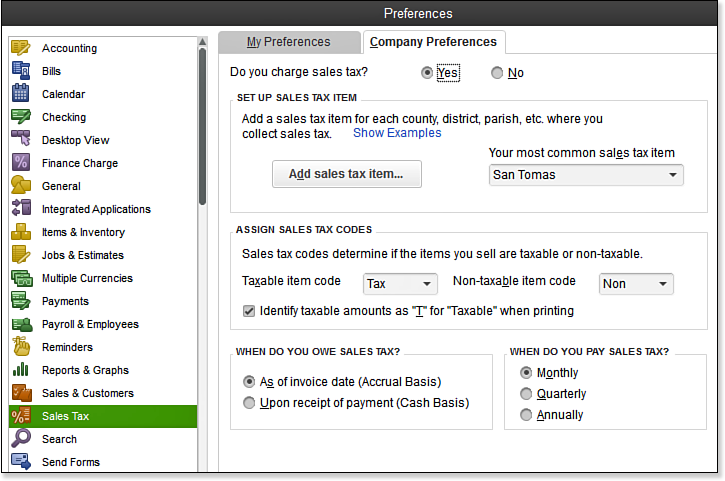

Before beginning the tasks listed below, you should review the client’s settings (preferences) for sales tax, as shown in here:

[1]

[1]Review Sales Tax preferences before making any corrections.

Additionally, the Sales Tax task group will not display in the CDR if the Sales Tax feature has not been enabled. After reviewing and correcting your client’s sales tax preference settings, you are prepared to begin the following CDR task.

Fix Incorrectly Recorded Sales Tax

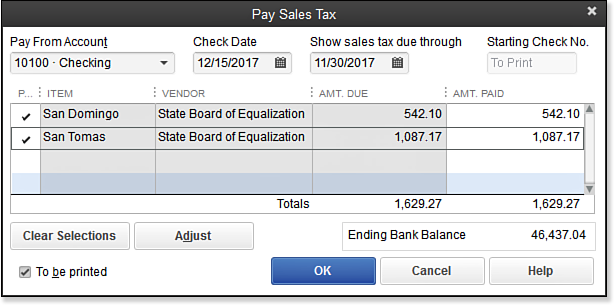

QuickBooks uses a special Pay Sales Tax dialog box (as shown in the image below) to record the sales tax liability payments properly. When payments are made using other transaction types, such as Write Checks, Pay Bills, or Make General Journal Entries, the Pay Sales Tax dialog box might not reflect the payments accurately.

[2]

[2]Create properly paid sales tax using the Pay Sales Tax dialog box.

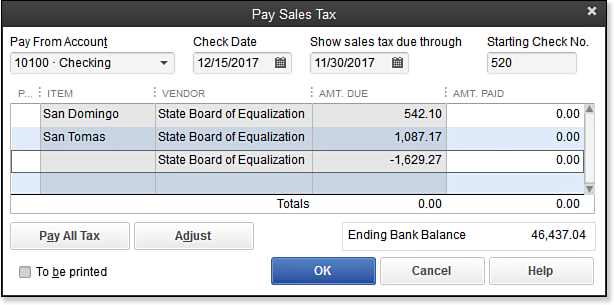

The Fix Incorrectly Recorded Sales Tax task will help you identify and correct the transaction when a client paid the sales tax liability outside of the Pay Sales Tax dialog box. The image below shows the negative line entry that will be included in the Pay Sales Tax dialog box when a Write Checks transaction was created, assigned to the sales tax payable liability account, and payable to the sales tax vendor. Properly recorded sales tax payments will have a transaction type of TAXPMT in the checkbook register.

[3]

[3]The Pay Sales Tax dialog box when an improperly recorded sales tax payment was made.

–> A word of caution: This might be a good time to review with your client the vendor names associated with different types of tax payments. Some states might have the same vendor name for multiple agency tax payments.

Suggest that your client use a unique vendor name for each different type of tax being paid. This will avoid CDR possibly correcting a non-sales-tax type of payment made to vendor.

What exactly is this tool fixing? The tool will identify and fix nonsales-tax payable type transactions used to pay sales tax liability using Void and Replace functionality. The tool will identify any Write Checks transactions where the payee is the same as an assigned payee for any sales tax item. This tool will not identify any vendor bills, vendor bill payment checks, or journal entries recording payment for the Sales Tax Liability.

If this is your first incorrectly recorded sales tax transaction fix, you might want to change the “to” date to include today’s date. This ensures you are seeing all sales tax payable transactions that were improperly recorded using the wrong transaction in QuickBooks.

–> Another word of caution: If your client has multiple lines recorded on sales tax payable checks, such as including an additional fee for late payment penalty or other adjustment lines, you might want to use the link for making a manual Sales Tax Adjustment. The Fix Incorrectly Recorded Sales Tax tool assumes all lines of the incorrect transaction belong in the Sales Tax Payable account.

To fix incorrectly recorded sales tax, follow these steps:

- If you are completing these changes as part of a dated review, from the menu bar select Accountant, Client Data Review and launch Client Data Review. You then select the Fix Incorrectly Recorded Sales Tax task in the Sales Tax group.

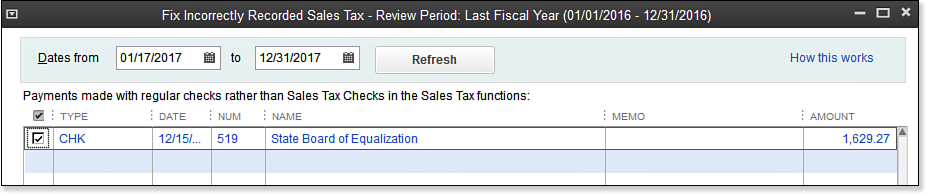

- If you are not completing these changes as part of a dated review, from the menu bar select Accountant, Client Data Review and launch the Fix Incorrectly Recorded Sales Tax task as shown here:

[4]

[4]Automatically find and fix incorrectly recorded sales tax payment transactions.

- Double-click any transaction to see the originally created non-sales-tax payment transaction to make sure it should be changed to a Sales Tax Payment. Make note of the check number or check date.

- Place a checkmark in each transaction to be fixed. (Optional) Use the Select All button or Deselect All button to streamline the process.

- Click Void & Replace (not shown in the above image, in step 2). CDR then creates a new Sales Tax Payment transaction, and voids the original Write Checks transaction or Make General Journal Entries transaction.

- Click Proceed to the Fix Sales Tax message that displays to continue with the change, or click Cancel to return to the CDR tool.

- Click OK to close the message indicating that the transaction(s) have been fixed.

- Click the X in the top-right corner to return to the CDR Center.

- Return to your checkbook register (icon on the Home page) and look for the check number or date (or both) to view the original transaction voided and the new transaction created as a Sales Tax Payment type.

Here’s another tip from Laura Madeira’s QuickBooks 2013 In Depth:

With the Void and Replace functionality included in the Fix Incorrectly Recorded Sales Tax tool, you are assured that if your original transaction was marked as cleared in a bank reconciliation, the newly created Sales Tax Payment transaction will also be marked as cleared.

From Laura Madeira’s QuickBooks 2013 In Depth[5]

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/05/28.bmp

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/05/A.29.bmp

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/05/A.30.bmp

- [Image]: http://www.quick-training.com/wp-content/uploads/2013/05/A.31.bmp

- QuickBooks 2013 In Depth: http://www.quick-training.com/quickbooks-2013-in-depth/

Source URL: http://www.quick-training.info/2013/09/06/how-to-fix-incorrectly-recorded-sales-tax-in-quickbooks/