Creating a bank deposit for your cash and check payments correctly is one of the important tasks necessary to properly track the balance of funds you have in your bank account.

To practice making a deposit, open a sample data file:

- On the Home page, click the Record Deposits icon.

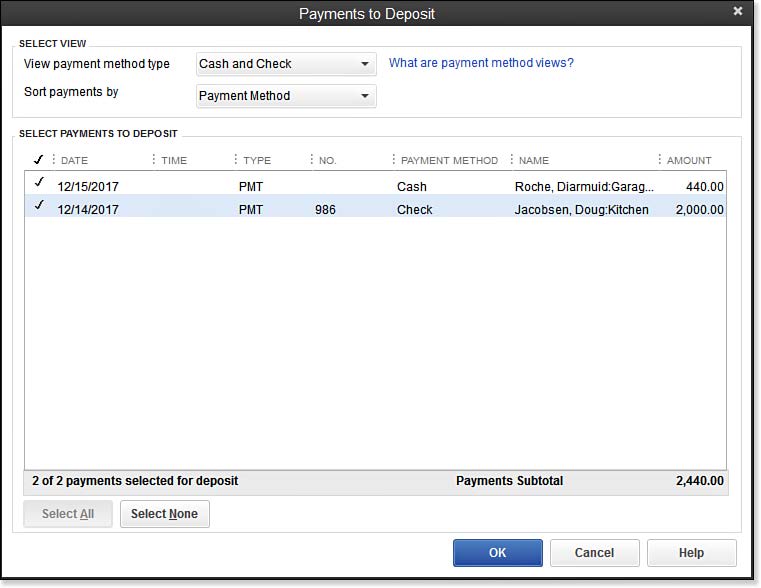

- Using the sample data for practice, the Payments to Deposit dialog box displays a listing of payments received that have not yet been recorded as a deposit into the bank account. When you are working in your data, if this message does not display, you do not have any payments that were recorded to the Undeposited Funds account.

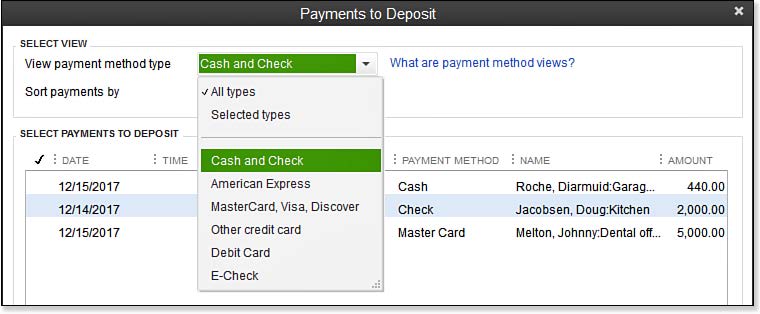

- From the View Payment Method Type drop-down list, select Cash and Check . This step is optional, but it helps to group the payments by the type of deposit.

- Click the Select All button to place a checkmark next to each of the amounts listed. (See image below.) Your total might differ if you did not complete the exercise in the previous section.

- Compare your deposit ticket total to the payments subtotal on the Payments to Deposit dialog box:

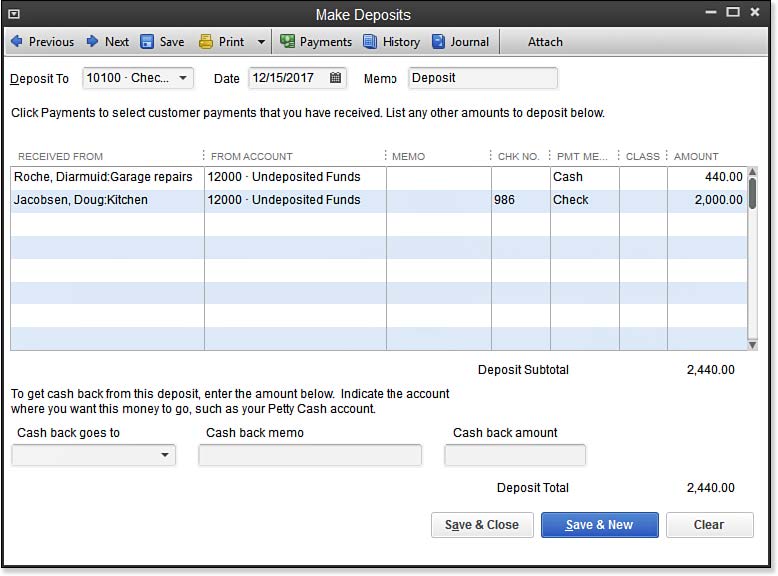

- When you click OK, QuickBooks adds the selected payments to the Make Deposits dialog box.

- Confirm that the Deposit To account is correct, and select the Date your bank will credit your account with the funds. Entering details in the Memo field will display in reports.

- From the Print drop-down list, select to print a deposit slip (preprinted forms are necessary) or print a deposit summary for your file, as shown here:

- Click Save & Close to complete the task or click Save & New to record another bank deposit.

It’s really that simple! Create an invoice, receive the customer’s payment, and make the deposit into your bank account records.

From Laura Madeira’s QuickBooks 2013 In Depth