Ensuring that all checks, bill payments, payroll checks, customer payments, and any other banking-related transactions have been entered in the QuickBooks data file is critical to the success in

accurate reporting in your own, or your client’s QuickBooks file. You don’t want to complete a multiyear or multimonth bank reconciliation if handwritten checks, or other bank transactions, have not

been recorded in the data.

A word of caution: As with any major task or adjustment you plan to make in your QuickBooks data, I recommend you make a backup copy. You can easily create this backup by selecting File, Create Backup from the menu bar, and then follow the instructions on the screen.

Creating a Missing Checks Report

To help you determine whether any check transactions are missing, create a Missing Checks report. To do so, follow these steps:

- From the menu bar, select Reports, Banking, Missing Checks report.

- In the Missing Checks dialog box, select the bank account from the drop-down list.

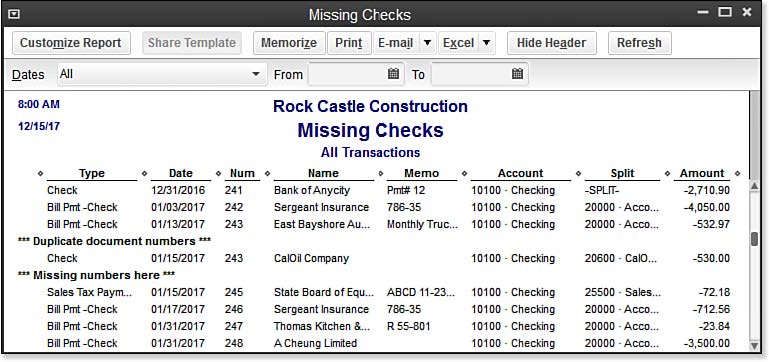

The resulting Missing Checks report shows all check or bill payment check type transactions sorted by number. Look for any breaks in the detail with a ***Missing or ***Duplicate warning, as shown here:

The Missing Checks report can help you determine whether you need to enter any missing transactions before you reconcile.