Did your research reveal Make Deposits transactions recorded directly to an income account instead of using the Receive Payments transaction? For the business owner, assigning the deposits to the customer invoice is a two-step process. If you have the time to correct individual transactions, this method retains your bank reconciliation status and identifies the payment with the customer’s open invoice. Be prepared for a bit of tedious work. You need to have a good record of which deposit was paying for which customer invoice. Remember, these steps are to correct transactions that have been recorded incorrectly.

–> Here’s a tip from Laura Madeira’s QuickBooks 2013 In Depth

I like using the Reports, Customers & Receivable, Open Invoices report because I can see both the unapplied credits and open invoices grouped by customer or job.

To manually correct recorded Make Deposits and apply them to the correct open invoice, follow these steps:

- From the menu bar, select Banking, Use Register.

- The Use Register dialog box opens. Select the bank account to which the deposit was made.

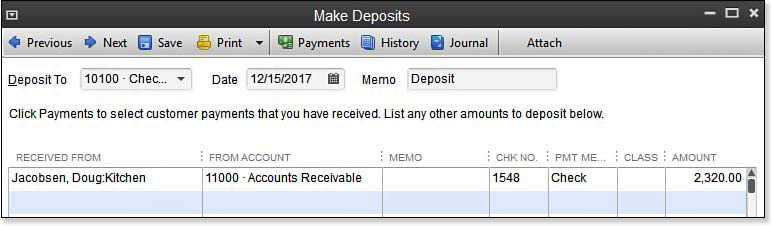

- Locate the deposit in the checkbook register and double-click it to open the Make Deposits transaction. Change the account assigned in the From Account column from Income to Accounts Receivable. The effect of this step is to “credit” or decrease, Accounts Receivable (see image below). Click Save & Close.

- From the menu bar select Reports, Customers & Receivables, Open Invoices, and double-click the unpaid invoice.

- From the Main tab of the ribbon toolbar, click the Apply Credits icon and select the credit that pertains to this invoice.

- Click Done to close the Apply Credits dialog box. Click Save & Close.

You have now corrected the deposit, and assigned the amount to the open customer invoice, all without changing your bank reconciliation status of the item. This process works well, but can be tedious if you have many transactions with this type of error.